The Benefits of ITR filing Income Tax Returns (ITRs)

Introduction

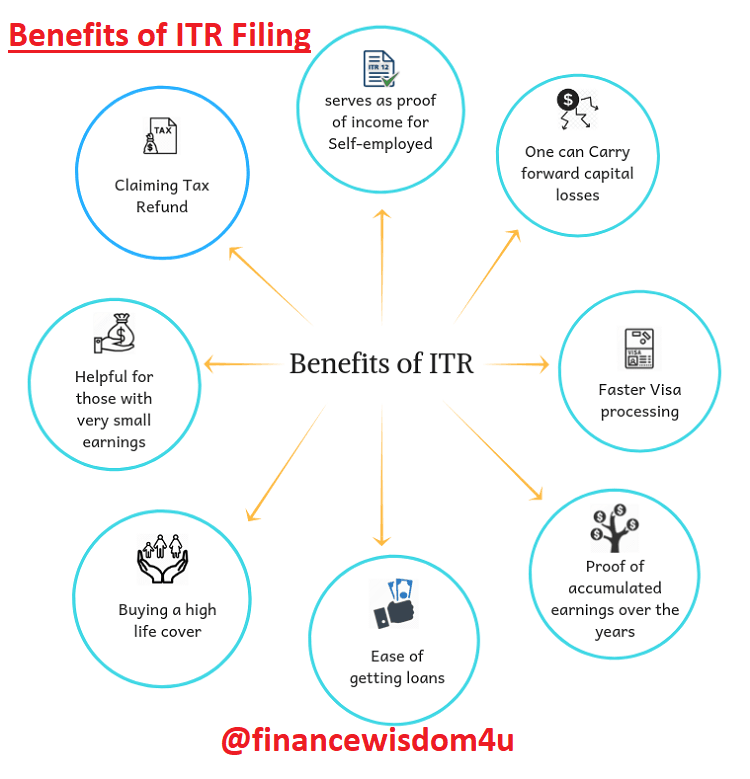

Filing income tax returns (ITRs) is a legal obligation for individuals and businesses in many countries including India. While many see it as a tedious task; the benefits of filing ITRs far outweigh the inconveniences. In this article, we will explore the various advantages of timely ITR filing and how it can positively impact individuals, businesses and the overall economy. In case you want to know more about ITR learn from ITR and its types

1. Compliance and Legal Obligations

Filing ITRs ensures compliance with tax laws and regulations. It demonstrates a responsible attitude towards fulfilling one’s legal obligations, fostering trust and transparency between taxpayers and the government. By maintaining a clean tax record, individuals and businesses can avoid penalties, notices, and legal consequences. Additionally, filing ITRs regularly can help build a solid financial reputation, which is crucial for obtaining loans, visas, and other financial transactions.

2. Claiming Tax Refunds

One of the primary benefits of filing ITRs is the opportunity to claim tax refunds. Taxpayers often overlook this aspect unaware that they may be eligible for refunds due to excess tax deductions or investments. By filing ITRs individuals can claim these refunds putting extra money back into their pockets. This can be particularly beneficial for salaried individuals who may have taxes deducted at source but are eligible for exemptions or deductions based on their investments and expenses.

3. Facilitating Financial Planning

ITR filing plays a crucial role in facilitating effective financial planning. It requires individuals to organize their financial records including income, expenses, investments, and assets. This exercise promotes a better understanding of their financial situation and helps identify areas for improvement. By analyzing the income-to-expense ratio individuals can make informed decisions about savings, investments and debt management. ITR filing also serves as a proof of income which can be necessary for availing loans, insurance or rental agreements.

4. Establishing Proof of Income

ITR filing serves as a proof of income for individuals and businesses. This documentation is essential for various purposes, including visa applications, loan approvals and rental agreements. By maintaining a consistent ITR filing history individuals can establish their financial stability and credibility enhancing their chances of success in these applications. Additionally, ITR filing records can be valuable during property transactions and legal disputes providing evidence of income and assets.

5. Avoiding Scrutiny and Future Hassles

Filing ITRs on time can help individuals and businesses avoid unnecessary scrutiny and future hassles. Tax authorities often focus on non-filers or irregular filers conducting audits and investigations to ensure compliance. By filing ITRs regularly individuals can minimize their chances of attracting unwanted attention from tax authorities. This reduces the likelihood of audits, notices, and penalties, saving time, money and stress in the long run.

6. Contributing to National Development

Filing ITRs is not just an individual obligation; it is also a contribution to national development. Taxes collected through ITRs play a vital role in funding government initiatives, infrastructure development, social welfare programs and public services. By fulfilling their tax responsibilities – individuals and businesses contribute to the growth and progress of the nation and ensuring a better future for all citizens.

Penalty/Punishment for not filing ITR

If an individual is exempt for tax filing then no fine is charged. But if an individual whose income is more than the exemption limit but less than ₹5 lacs then ₹ 1000 is charged. If an individual income is more than lacs then ₹5000 is charged. In some rare case, prosecutions case can also be charged by the govt and imprisonment of 3 months- 7 years.

So, it is very important to file an ITR within the due date.

Conclusion

In conclusion, the benefits of filing income tax returns (ITRs) extend beyond mere compliance. Timely ITR filing helps individuals and businesses establish financial credibility, claim tax refunds, facilitate financial planning and avoid scrutiny and future hassles. It also serves as proof of income which is essential for various financial transactions. Moreover by fulfilling their tax obligations, taxpayers contribute to national development and the overall well-being of society. It is crucial for individuals and businesses to understand and appreciate these benefits – motivating them to file ITRs promptly and accurately.

Filing ITRs can also provide individuals with a sense of personal responsibility and accountability. By fulfilling their tax obligations individuals demonstrate their commitment to being active and responsible members of society. This can foster a sense of pride and satisfaction in contributing to the functioning of the government and the welfare of the nation. Timely ITR filing can help individuals build a positive reputation within their professional and social circles, as it showcases their integrity and adherence to legal and financial norms. Overall, filing ITRs goes beyond financial benefits and serves as a reflection of an individual’s character and commitment to their civic duties.