Understanding Capital Gains in India: A Simple Guide

Investing in various assets can be a rewarding endeavor, but it’s essential to grasp the concept of capital gains and its implications. In this article, we’ll explore what capital gains are, the types of capital gains, and their significance for Indian investors.

Note: Please verify current asset taxation regulations for the latest information."

What is Capital Gain?

Capital gain refers to the profit earned from the sale of a capital asset, such as real estate, stocks, or mutual funds. It is the difference between the purchase price (cost of acquisition) and the selling price of the asset. If the selling price is higher than the purchase price, you incur a capital-gain; if it’s lower, you incur a capital loss.

It is a profit or gain received by selling the capital assets. Capital assets are any fixed assets owned by an assessee for individual or business purposes. Examples are stocks, bonds, real estate, jewellery – made from gold, silver, platinum or precious stones etc. In capital-gain the selling value is more than the purchase value. The capital assets increases its value with the time. Capital Gains are taxable as the profit earned by the assessee by selling the assets at higher value is considered as an income for the assessee under the income tax law.

In India, capital gains are categorized into two main types: short-term capital-gains (STCG) and long-term capital-gains (LTCG).

Short-Term Capital Gains (STCG)

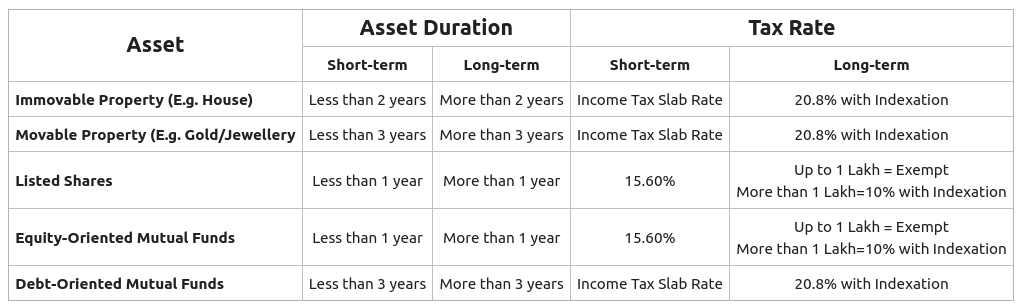

Short-term capital gains are profits made from the sale of assets held for a short period, typically up to 36 months. The holding period varies for different assets:

- Equity Shares and Mutual Funds:

For shares of a company listed on a recognized stock exchange or equity-oriented mutual funds, if the holding period is less than 12 months, the gain is considered a short-term capital gain. - Debt Mutual Funds and Other Assets:

For assets like real estate, gold, and debt-oriented mutual funds, a holding period of fewer than 36 months qualifies as short-term.

Taxation of Short-Term Capital Gains

Short-term capital-gains are taxed at the individual’s applicable income tax slab rates. This means that the gains are added to your total income for the financial year, and you are taxed accordingly.

Long-Term Capital Gains (LTCG)

Long-term capital-gains arise from the sale of assets held for an extended period, exceeding the specified duration for each asset:

- Equity Shares and Equity-Oriented Mutual Funds:

If the holding period is more than 12 months, gains from the sale of equity shares or equity-oriented mutual funds qualify as long-term. - Real Estate and Other Assets:

For other assets like real estate, gold, and debt-oriented mutual funds, a holding period of more than 36 months is considered long-term.

Taxation of Long-Term Capital Gains

The taxation of long-term capital-gains varies based on the type of asset:

- Equity Shares and Equity-Oriented Mutual Funds:

As of the 2021 Union Budget, long-term capital-gains on equity shares and equity-oriented mutual funds are subject to a flat tax rate of 10%, exceeding an exemption limit of Rs. 1 lakh. - Real Estate and Other Assets:

For real estate and other assets, LTCG is taxed at 20% after indexation. Indexation is a method that adjusts the purchase price based on the inflation rate, reducing the taxable capital-gain.

Indexation and Its Role in Long-Term Capital Gains

Indexation plays a crucial role in computing the cost of acquisition for long-term assets. By adjusting the purchase price for inflation, it helps reduce the taxable portion of the capital-gain. The Central Government provides an inflation index, and investors can use it to compute the indexed cost of acquisition.

Exemptions and Deductions

Certain exemptions and deductions are available to reduce the tax liability on capital gains:

- Exemption under Section 54:

If the capital gain arises from the sale of a residential property, the amount can be invested in another residential property within a specified time frame to claim exemption from capital gains tax. - Exemption under Section 54F:

This section provides exemptions for individuals selling any asset (except residential property) and investing the proceeds in a new residential property.

More details about Section 54

Sections 54E, 54EA and 54EB provide opportunities for individuals to claim tax exemption by investing in specific securities including UTI units, Government Securities, Targeted Debentures, Government Bonds, etc. Any income generated from these investments is exempt from income tax.

In the case of Section 54EC individuals can avail of income exemption by reinvesting the proceeds from the sale of long-term assets into specified long-term assets.

Section 54EE allows individuals to claim exemption on the proceeds obtained through the transfer of investments.

For Section 54, individuals can claim exemption on the proceeds earned from the sale of residential housing property.

Under Section 54F individuals can claim exemption on the proceeds earned from the sale of capital assets, excluding residential housing property.

Conclusion

Understanding capital gains and their taxation is essential for every investor. Whether you’re investing in stocks, mutual funds, or real estate, being aware of the tax implications can significantly impact your overall returns. It’s advisable to consult with a financial advisor to make informed decisions and optimize your investment strategy.

In conclusion, as an Indian investor, navigating the complexities of capital gains can seem challenging at first, but with the right knowledge and guidance, you can make informed investment decisions that align with your financial goals.

Learn TDS and Advance Tax as it is very important to know once you understand Capital gain and its types