The Power of Compounding – Ultimate guide for Wealth Creation

Introduction

Welcome to financewisdom4u blog! In this article, we are going to dive into the fascinating world of “power of compounding” and how it can help you grow your wealth over time. Whether you are just starting your financial journey or have been investing for years, understanding the power of compounding is essential for building a solid financial future.

What is Compounding?

Compounding is the process of reinvesting your investment earnings, allowing them to generate even more earnings. In simpler terms, it means making money on your money. The earlier you start investing, the more time your money has to compound and grow.

Let’s look at an example. If you were to invest $1,000 at an annual interest rate of 8%, after one year, you would have $1,080. But instead of withdrawing that $80, if you leave it invested, it will continue to compound over time. After 10 years, your initial $1,000 investment would grow to $2,159.63! . Lets understand compounding and see how it works.

Understanding Compounding

Compounding refers to the process of earning interest on both the original amount invested and the accumulated interest. In other words, it’s the snowball effect where your money grows exponentially over time. The longer you stay invested, the more significant the impact of compounding becomes.

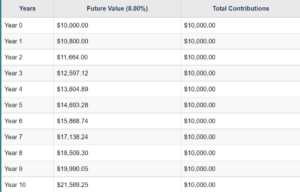

Let’s consider an example to illustrate the power of compounding. Suppose you invest $10,000 in a mutual fund that earns an average annual return of 8%. After one year, your investment will grow to $10,800. In the second year, you will earn 8% not just on your initial $10,000, but also on the additional $800 earned in the first year. This compounding effect continues to multiply your wealth as time goes by.

As you can see from the table above, the power of compounding becomes more apparent over time. The interest earned on your initial investment keeps growing, leading to significant wealth accumulation.

The Magic of Time

One of the key ingredients of compounding is time. The longer you stay invested, the more your money can grow. This is due to the power of exponential growth. As your investment earnings generate more earnings, your wealth can multiply at an accelerating rate.

For example, let’s say you start investing $500 per month at the age of 25 and continue until you retire at the age of 65. Assuming an average annual return of 7%, by the time you retire, you would have accumulated over $1 million! This is the power of compounding over a long period of time.

How Does Compounding Help in Wealth Creation?

Compounding is a wealth-building tool that thrives on time. The earlier you start investing, the longer your money has to grow and compound. This can significantly impact your financial future.

Consider two individuals: Emily and John. Emily starts investing $100 per month at the age of 25 and continues until she reaches 65. John, on the other hand, decides to start investing the same amount but delays until he turns 35. Both Emily and John earn an average annual return of 8%.

By the age of 65, Emily’s investment would have grown to approximately $427,000. In contrast, John’s investment, despite contributing for 30 years, would only reach around $208,000.

Emily benefits from the extra ten years of compounding, which makes a substantial difference in her accumulated wealth.

How Can You Leverage the Power of Compounding?

Regardless of your age, you can harness the power of compounding using these strategies:

- Start Investing Early: Time is your ally when it comes to compounding. The earlier you start, the more significant the impact. Begin investing as soon as possible and allow your investments to grow steadily over time.

- Be Patient and Stay Invested: Avoid the temptation to withdraw your investments prematurely. Let the power of compounding work its magic over the long term. Patience is key to maximizing the benefits.

- Invest Regularly: Consistency is crucial. Invest a fixed amount of money regularly, even if it’s a small sum. Regular contributions, combined with compounding, can lead to substantial wealth accumulation.

- Diversify Your Investments: Spread your investments across different assets and sectors to minimize risk. Consider options such as stocks, mutual funds, or index funds that have the potential for higher returns.

- Seek Professional Guidance: Consult with a financial advisor or expert who can provide personalized advice based on your financial goals and risk tolerance. They can help you optimize your investment strategy and make informed decisions.

Conclusion

The power of compounding is a remarkable tool for building wealth. It doesn’t require advanced financial knowledge or massive investments. By starting early, being patient, investing regularly, and diversifying your portfolio, you can take full advantage of compounding’s potential. Remember, the small steps you take today can pave the way for a financially secure future. Start harnessing the power of compounding and watch your wealth grow over time.