What is National Pension Schema(NPS)

The National Pension Schema(NPS) – It is a voluntary retirement savings and pension scheme in India and it is supported by government. It was introduced in 2004 for government employees but was reintroduced in 2009 for all other sections. It is regulated and managed by the Pension Fund Regulatory and Development Authority (PFRDA).

In the National-Pension-Scheme (NPS), personal savings are consolidated into a pension fund. This fund is then managed by professional fund managers regulated by the Pension Fund Regulatory and Development Authority (PFRDA). These managers invest the funds in a diverse range of portfolios, including Government Bonds, Bills, Corporate Debentures, and Shares.

NPS account can be opened from any banks, post offices or any visiting branch. An individual can open only one account. Multiple accounts are not allowed.

Why to invest in NPS?

- NPS promotes the concept of saving for retirement amongst citizens.

- NPS accumulate a substantial corpus that will provide financial security during retirement.

- It also helps in tax saving

- It helps the senior citizen to live their retirement life comfortably without depending on others.

- It provides safe and reasonable market-based returns over the long term

- The NPS money is directly submitted to the government hence makes it a safe saving option. The banks/post offices acts as only third parties and the account is opened with the government of India.

- It is voluntary and open for every citizen and have the freedom to decide the amount one wish to allocate.

Features of National Pension Schema(NPS)

1.Age Criteria

- Any individual who is between the ages of 18 and 70 can join the NPS. The minimum contribution period under the NPS is 20 years or until the age of 60, whichever is earlier. The exit age for the NBS set by the government is 60 years. So, once you attain this age you can withdraw the 60% of the NPS corpus in a lump sum manner and the rest 40% you can avail as monthly pension.

2.Taxation:

- Contributions made by an individual under the NPS are eligible for a deduction under Section 80CCD(1) of the Income Tax Act, up to a maximum limit of 10% of the individual’s salary (Basic + Dearness Allowance) subject to a maximum limit of Rs. 1.5 lakh (for salaried individuals) or 20% of the individual’s gross total income subject to a maximum limit of Rs. 1.5 lakh. (for self-employed individuals).

- An additional deduction of up to Rs. 50,000 is available under Section 80CCD(1B), which is over and above the limit mentioned above.

- Employer contributions to an employee’s NPS account, up to 10% of the employee’s salary, are also eligible for a deduction under Section 80CCD(2).

- This scheme is considered as a good option for Tax Rebate. Under this scheme an individual can save more than 2 lakhs of tax.

3. Withdrawal on Retirement:

- NPS participants, upon retirement, have the option to withdraw up to 60% of the total accumulated funds from their Tier 1 account as a lump sum. The remaining 40% is required to be used to purchase an annuity, which ensures a consistent pension income. This allocation offers financial flexibility to retirees for their post-retirement plans.

4. Partial Withdrawal:

- The NPS account holder is allowed to make withdrawals from their NPS account only three times during their tenure. A premature withdrawal of up to 25% of the subscriber contributions is possible in case of any financial emergencies.

5. Types of NPS account:

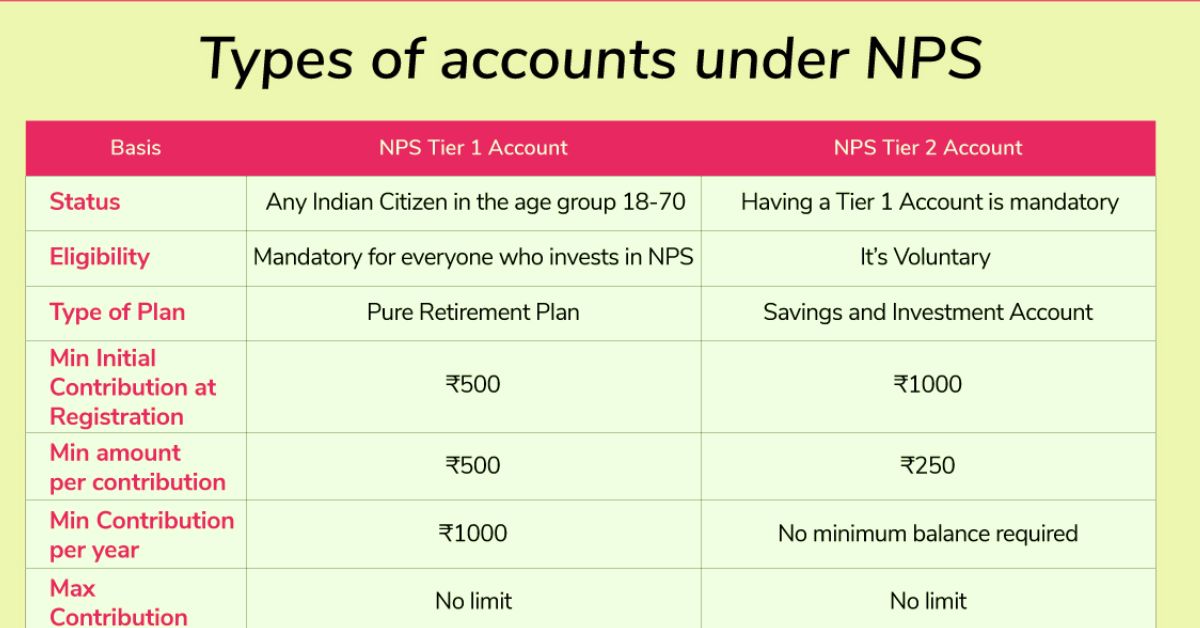

The National Pension Schema (NPS) features two main types of accounts: Tier I and Tier II. The former serves as the default account, while the latter is an optional addition that individuals can choose to open voluntarily.

- Tier I Account (Pension Fund): It is the primary and mandatory account in the National Pension Schema in India. It serves as the core retirement savings account and is for building retirement corpus. The withdrawal options are limited on this account. It provides tax benefit under section 80 CCD.

- Tier II (Investment Fund): It is an optional and voluntary account that can be opened by individuals who already have a Tier-I account. It is just a normal account or mutual fund accounts where we can add or withdraw any time. It does not provide tax benefit like Tie I account.

- Fund can be transferred from Tier II to Tier I but not from Tier I to Tier II.

6. Nomination:

- NPS encourages the subscriber to nominate individual or multiple nominees who will receive the NPS fund upon the death of the subscriber. Nomination is done at the time of account opening and can be updated/modified later on. A nominee can be any individual, including a family member, spouse, child, or any other person chosen by the subscriber.

- NPS enables subscribers to distribute a portion of the accumulated corpus among their nominees by specifying the percentage allocation. This means that, following the subscriber’s demise, a designated percentage of the NPS funds can be shared among the nominees as per the subscriber’s preferences, ensuring that the total allocation adds up to 100%.

7. Where the NPS amount is invested:

- NPS allows subscribers to choose where and how much the contributions can be invested. There are three fund option out of which subscribers can select:

- 1. Equity (E): This option primarily invests in equities or stocks, potentially offering higher returns but with greater market-related risks.

- 2. Corporate Bonds (C): This option invests in fixed-income securities issued by corporations, offering a balance between returns and risk.

- 3. Government Securities (G): This option predominantly invests in government bonds and securities, which are considered low-risk but generally offer lower returns.

- There are two choices (1) Active Choices and (2) Auto Choices. Under active choices subscribers can himself actively manage and allocate funds as per their risk tolerance and investment preferences. In equity maximum 75 % of funds can be allocated up to 50 years of age and then the percentage is reduced and for the other two there is no specific limit. In Auto choice, the allocation of funds is automatically adjusted based on the subscriber’s age. Here the Pension Fund Managers (PFMs) manages the fund investments in NPS.

Types of NPS Accounts

Tier I and Tier II are the two primary account types under the NPS. The first is the default account, while the second is an optional addition. The table below provides a detailed explanation of the two account kinds.

| Particulars | Tier – 1 Account | Tier – 2 Account |

| Status | Default | Voluntary |

| Withdrawal | Not Permitted | Permitted |

| Tax Exemption | Until Rs.2 lakhs per annum | From Rs 1.5 lakh for government employees and none for others |

| Minimum Contribution | From ₹500 or ₹1000 per annum | ₹250 |

| Maximum Contribution | No Limit | No limit |

How to Apply for NPS Account

Here’s how to open a National Pension Scheme online and offline

How to Open NPS Account Online

- Individuals can register and obtain a subscription to the National-Pension-Scheme through the online platform eNPS. Registration for the scheme can be done in the following below steps :-

- Step i – Go to the eNPS portal available at the official website of the NPS

- Step ii – Choose your subscriber type from the available options “Individual Subscriber” & “Corporate Subscriber”.

- Step iii – Choose your suitable residential status. The options include “Citizen of India” & “NRI”.

- Step iv – Opt for either Tier I account type or both accounts, as a choice of the former is mandatory for long-term savings.

- Step v – Enter your PAN details and select a suitable bank or PoP. It is ideal to choose a PoP with whom you have an existing relationship, such as a savings/current/Demat/account for KYC verification, as the chosen PoP will do it.

- Step vi – Upload the scanned copy of your PAN card along with a cancelled cheque. The image-format should be in .jpg, .jpeg or .png format with a file size of 4KB to 2MB.

- Step vii – Next, upload your scanned photograph and signature in the same format and size as above.

- Step viii – Once routed to the payment gateway, proceed to pay the required charges via Net Banking.

- Step ix – With the completion of payment, your Permanent Retirement Account Number(PRAN) will be generated.

How to Apply for NPS Account Offline

- To open an NPS account offline or manually, you must first locate a Point of Presence[PoP] (which might be a bank). Collect a subscriber form from your nearest PoP and turn it in with your KYC documents and submit it. If you are already KYC compliant with that bank, disregard it.

- The PoP will issue you a PRAN – Permanent Retirement Account Number (PRAN) – once you make the initial contribution (not less than Rs.500, Rs.250 monthly, or Rs.1,000 annually).

- This PRAN number, along with the password in your sealed welcome kit, will assist you in operating your account. This method requires a one-time registration cost of Rs.125.

How to Log In to the NPS Account

After your account is created and PRAN is allocated, log in to your E- NPS account through various mediums, such as via the NSDL NPS portal, the KFintech portal or net banking account.

Let us understand the process to log in to your PRAN account-

Through NSDL NPS Portal

- 1. Visit the official portal of NSDL NPS at https://enps.nsdl.com/eNPS/NationalPensionSystem.html.

- 2. Click on ‘Login with PRAN/IPIN’.

- 3. Log-in screen will be displayed.

- 4. If you have PRAN and password, enter it and click on Submit to access your respective E-NPS account.

If you are logging in for the first time, you will have to create a new password using the following steps :-

- 1. Open the official portal of NSDL NPS at https://enps.nsdl.com/eNPS/NationalPensionSystem.html

- 2. Click on ‘Login with PRAN/IPIN’.

- 3. The log-in screen will be displayed.

- 4. Click on ‘Reset Password’ to generate a new password.

- 5. On this screen, you will have to provide your PRAN, date of birth, and new password. Confirm the password and then the CAPTCHA. Finally, click on Submit.

- 6. You will get an OTP on your registered mobile number. Enter OTP on the screen to confirm your new password. Now, you will be able to log in to your E-NPS account using your PRAN and new password.

Through KFintech NPS Portal

- 1. Visit the KFintech NPS official portal at https://nps.kfintech.com/.

- 2. Click on ‘Login’ and then click on ‘Existing Subscriber’.

- 3. On the login screen, enter your PRAN, password and Captcha code to log in.

If you are logging in for the first time, follow the steps mentioned below :-

- 1. Visit the KFintech NPS official portal at https://nps.kfintech.com/.

- 2. Click on ‘Login’ and select ‘Existing Subscriber’.

- 3. On the login screen, click on ‘Generate/Reset password’.

- 4. Next, enter your PRAN, date of birth and Captcha code. Click on ‘Submit’. You will receive an OTP on your registered phone number. Enter the OTP and then set a new password. Once you create a new password, you can use it to log in to your E-NPS account.

Tax Benefits on NPS Account

Tax benefits for National-Pension-Scheme investments are available under the following sections

| Applicable Sections under the Income Tax Act 1961 | Tax Benefits Allowed |

| U/S 80CCD (1) | Own contribution of a subscriber towards Tier I investments tax-deductible within the total ceiling of Rs.1.5 lakh u/s 80C. |

| U/S 80CCD 1(B) | In addition to deductions under section 80CCD (1), subscribers are allowed up to Rs.50,000 as deductions towards Tier I contributions. |

| U/S 80CCD (2) | Contribution of an employer towards Tier I investments is eligible for deduction up to 14% for central government contributions and up to 10% for others. This deduction is over and above the deduction limit applicable u/s 80C. |

The National-Pension-Scheme Details has other tax benefits on NPS Tier I investments including –

- 1. Up to 25% of Tier I contributions withdrawn by a subscriber are exempt from tax.

- 2. Annuity purchase from the National-Pension-Scheme corpus is tax-exempt. However, income generated from such an annuity in the following years is taxable as per tax slab.

- 3. Lump-sum withdrawal of up to 40% of an NPS corpus after a subscriber turns 60 is exempt from tax.

After reaching the age of 60, if the corpus generated through the National Pension System totals Rs. 20 lakh, withdrawing 40% of it as a lump sum, which equals Rs. 8 lakh, won’t incur any tax. Moreover, if you use the remaining 60% for buying annuities, the entire corpus will be tax-free. Only the income generated from the annuities will be taxable.

How to check NPS balance?

NPS offers both online and app facilities to check NPS account balance and NPS account statements.

Online method:

Step 1: Go to the CRA website and log in to your NPS account by entering your correct credentials such as your Permanent Retirement Allotment Number (PRAN) number as user ID and your account password.

Step 2: After successful CRA website login, proceed to select the Transaction Statement button and then click on the Holding Statement button. This will display your accumulated NPS balance amount.

Step 3: Click on ‘Transaction statement’ button to generate the details of your transactions (including your contributions).

App method:

The Unified Mobile Application(UMANG) for New-age Governance platform plays a significant role in checking your NPS account balance through the app. UMANG is a government initiative to offer individuals a range of E-gov services under a single platform. Both Employee Provident Fund Organization (EPFO) and NPS services are easily available on the UMANG platform.

Download the UMANG app and log in. Then, search for NPS and enter your NPS log in details for NPS balance check.

NPS partial withdrawal (New Rules)

To be eligible for partial withdrawal, subscribers must adhere to the following guidelines:

- Membership Duration: Subscribers must have been NPS members for a minimum of three years from their enrollment date.

- Withdrawal Limit: Partial withdrawals cannot exceed 25% of the total contributions in the subscriber’s individual pension account, excluding the employer’s contributions, at the time of application. Returns on contributions are ineligible for partial withdrawal.

- Withdrawal Frequency: Subscribers are allowed a maximum of three partial withdrawals throughout their entire subscription period. Subsequent withdrawals are permissible, but only from the incremental contributions made since the last withdrawal.

In addition to these updates, NPS now permits partial withdrawals for various reasons, including:

- Funding higher education for the subscriber’s children, including legally adopted children.

- Covering marriage expenses for the subscriber’s children, including legally adopted children.

- Financing the purchase or construction of a residential property in the subscriber’s name or jointly with their legally wedded spouse. However, no withdrawal is permitted if the subscriber already owns a residential property (excluding ancestral property).

- Funding treatment for specified illnesses such as cancer, kidney failure, Covid-19, and others.

- Covering medical and incidental expenses due to the subscriber’s disability or incapacitation.

- Financing expenses for skill development, re-skilling, or other self-development activities.

- Funding expenses for establishing the subscriber’s own venture or any start-ups.

NPS Customer Care Number

- NPS SMS Number: Send NPS to 56677

- NPS Call Centre Number: Dial 1800 110 708

- NPS Toll-Free Number For Registered Subscriber (with PRAN): Dial 1800 222 080

Frequent Asked Questions (FAQs):

1. Who is eligible to join the NPS?

Any Indian citizen aged between 18 and 65 at the time of application is eligible to invest in NPS. Individuals or employee-employer groups can join the NPS. However, OCI (Overseas Citizens of India), PIO (Person of Indian Origin) cardholders, and HUFs (Hindu Undivided Families) are not eligible to open an NPS account.

2. What are the Tier 1 and Tier 2 NPS accounts?

NPS offers two types of accounts: Tier I and Tier II.

Tier I accounts are mandatory for NPS investments and enjoy all associated tax benefits. However, they operate as restricted retirement accounts with conditional withdrawals, available only upon meeting NPS exit conditions.

Tier II accounts are optional and can be linked to any Tier I account. Funds from this account can be withdrawn at any time, but there are no tax advantages associated with Tier II investments.

3. How does NPS annuity income get taxed?

The taxation of NPS annuity income differs from the taxation of the contributions and withdrawals in NPS. While NPS contributions and withdrawals are generally tax-free, the annuity income received from NPS is subject to taxation.

When you receive annuity income from NPS, it is treated as regular income and is taxed according to your applicable income tax slab rate. This means that the annuity income is added to your total taxable income for the year, and you are taxed accordingly.

So, while NPS itself may be considered an EEE (Exempt-Exempt-Exempt) product, meaning that contributions, returns, and withdrawals are tax-exempt, the annuity income received from NPS is taxable as regular income.

Conclusion

In conclusion, the National Pension Scheme (NPS) stands as a robust investment avenue for individuals seeking to secure their financial future during retirement. With its market-linked features, professional fund management, and tax benefits, NPS offers a prudent platform for long-term wealth accumulation. The scheme’s flexibility, evidenced by partial withdrawal options and tiered account structures, caters to diverse financial goals and needs.

While NPS provides tax advantages throughout the investment journey, it’s essential to note that annuity income received upon retirement is subject to taxation. Nevertheless, the overall benefits of NPS, coupled with its regulated framework and transparent operations, make it a compelling choice for those planning for retirement and financial security. As individuals navigate their retirement planning journey, NPS emerges as a reliable partner in ensuring a comfortable and stable post-retirement life. For more insights and financial guidance, follow financewisdom4u.