Introduction

In the world of finance, bonds play a crucial role as a means of raising capital for corporations and governments. But what exactly is a bond? In simple terms, a bond is a debt instrument that allows an entity to borrow money from investors. Investors who purchase bonds essentially become lenders, providing the issuer with the necessary funds. Bonds are considered to be one of the safest investment options available, making them popular among risk-averse individuals.

What is a Bond ?

In simple terms, A bond is a type of fixed-income security that enables a lender to lend a predetermined sum of funds and earn interest on that investment. When you buy a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

A bond is essentially an IOU, a promise to repay a loan with interest over a specified period of time. The issuer, whether it’s a corporation or a government entity, offers bonds to investors in exchange for their capital. Bonds are typically issued with a fixed face value, or the amount that will be repaid at maturity, along with a predetermined interest rate, also known as the coupon rate. The interest on bonds is usually paid semi-annually or annually, providing investors with a steady income stream.

Including bonds in an investment portfolio is generally advisable as they contribute to risk diversification. In the event of a sharp decline in stock markets, bonds can provide a protective buffer.

Learn about Bonds vs Stocks

Terms Related to Bonds

- Issuer: The entity (government, corporation, or other organization) that borrows money by issuing the bond.

- Face Value/Par Value: It is the set amount of a bond, indicating what the issuer promises to pay back to the bondholder when the bond matures.

- Coupon Rate: It’s the interest rate specified in the bond that the issuer has to pay to the bondholder. These interest payments can happen every quarterly, semi-annually or annually. It is usually expressed as a percentage of the face value.

- Coupon Payment: The periodic interest payment made to bondholders, usually quarterly, semi-annually or annually.

- Coupon Payment Date: It is the declared date on which the issuer of a bond is scheduled to make an interest payment to bondholders.

- Issue date: It is the date on which the bond is initially offered and sold by the issuer to investors

- Maturity Date: The date on which the issuer repays the principal amount to the bondholder.

- Yield to Maturity (YTM): The total return anticipated on a bond if held until it matures.

Understand Bonds Terms with an Example

Bond Details:

Face Value/Par Value: $1,000

Coupon Rate: 4%

Coupon Payments: Semi-annual

Maturity Date: 10 years

Issue Date: January 1, 2023

In this example

- Face Value/Par Value: The bond has a face value of $1,000, which is the amount the issuer promises to repay the bondholder at maturity.

- Coupon Rate: The bond has a fixed coupon rate of 4%, meaning the bondholder will receive 4% of the face value as interest each year.

- Coupon Payments: The interest payments are made semi-annually, so bondholders will receive interest payments every six months.

- Maturity Date: The bond has a maturity period of 10 years, at which point the issuer will repay the bondholder the face value.

- Issue Date: The bond is issued on January 1, 2023.

Calculation of Coupon Payments :

Annual Interest Payment = $1,000 * 4% = $40

Semi-annual Interest Payment = $40 / 2 = $20

Coupon Payment Date:

The bondholder receives $20 as interest every six months.

Cash Flow for Bondholder:

Every six months, starting from July 1, 2023, the bondholder receives $20 as interest.

At the end of the 10-year period (January 1, 2033), the bondholder receives the face value of $1,000.

This is a simplified example, but it demonstrates the basic mechanics of how bonds work. Bonds provide a fixed income stream to investors in the form of regular interest payments and the principal is returned at maturity.

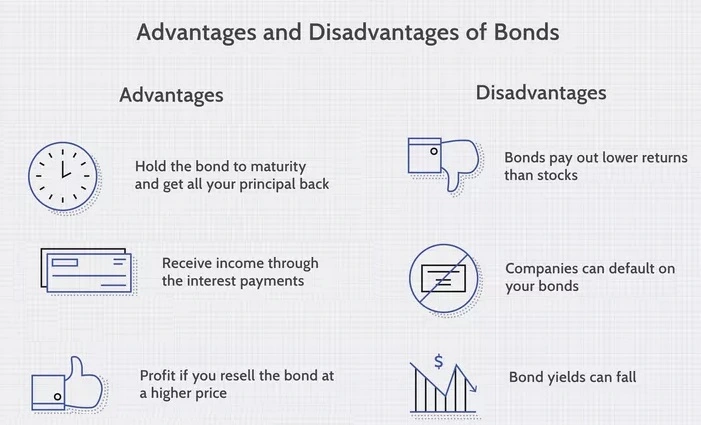

What are the Advantages of Bonds for Investors ?

Investing in bonds offers several advantages that make them an attractive option for many investors.

- Stability and predictability: Bonds are considered to be relatively safer investments compared to stocks or other asset classes. The regular interest payments provide a stable income stream and the return of principal at maturity offers predictability.

- Preservation of capital: Bonds offer the assurance of return of principal at maturity, making them an attractive option for investors looking to preserve their capital.

- Diversification: Bonds add diversification to an investment portfolio, reducing overall risk. Bonds often have a negative correlation with stocks, meaning that when the stock market declines, bond prices tend to rise. This helps to balance out the risk and volatility in a portfolio.

- Income generation: Bonds provide investors with a steady income stream through regular interest payments. This can be particularly beneficial for retirees or individuals seeking a consistent source of income.

- Liquidity: Bonds are often traded in liquid markets, allowing investors to buy or sell them relatively easily.

- Risk Management: Bonds issued by entities with high credit ratings are generally considered less risky, providing a way for investors to manage risk in their portfolios.

What are the Disadvantages of Bonds ?

While bonds have several advantages, it’s important to consider the potential drawbacks before investing.

- Lower Potential Returns: Compared to stocks, bonds typically offer lower potential returns, which may not keep pace with inflation over the long term.

- Inflation Risk: The fixed interest payments of bonds may not keep up with inflation, leading to a decrease in real purchasing power over time.

- Credit Risk: There is a risk that the bond issuer may default on interest payments or fail to repay the principal amount at maturity, especially with lower-rated or high-yield bonds.

- Market Fluctuations: Bond prices can be influenced by economic conditions, market sentiment, and geopolitical events, leading to fluctuations in the market value of bonds.

What are the types of Bonds?

- Corporate Bonds: A corporate bond is a debt security issued by a corporation to raise capital from the public or institutional investors. Read more about the Corporate Bonds.

- Government bonds: This are issued by the central and state government and it is managed by the Central Government. This is considered to be the safest bond as it is backed by government. Read more about the Government Bonds . Even the government offers the Sovereign Gold Scheme, which is also considered the safest investment. Read more about the Sovereign Gold Bond Scheme (SGB).

- Municipal Bonds: It is often referred to as “munis,” and are issued by state or local governments, as well as their agencies, authorities, and special districts.

- Secured Bonds: In these bonds company assets are kept as security to provide protection to the bondholder in case of issuer default. Read more about Senior Secured Bonds.

- Unsecured Bonds: It is also known as debentures and it is not backed by specific collateral or assets. Unlike secured bonds, if the issuer defaults, unsecured bondholders do not have a specific claim on assets for repayment. Instead, they rely on the issuer’s general creditworthiness.

- High Yield Bonds: High-yield bonds, commonly known as “junk bonds,” are bonds issued by companies or entities with lower credit ratings. These bonds carry a higher risk of default compared to investment-grade bonds, but they offer higher yields to compensate investors for the increased risk.

- Zero-Coupon Bonds: Zero-coupon bonds are debt securities that do not make regular interest payments (coupon payments) like traditional bonds. Instead, they are issued at a discount to their face value and do not provide periodic interest income to the bondholder. The investor earns a return by purchasing the bond at a discounted price and receiving the full-face value at maturity. The difference between the purchase price and face value represents the implicit interest or yield to maturity.

- Fixed Rate Bonds: Fixed-rate bonds, as the name suggests, are debt securities that pay a fixed rate of interest over their entire term. The interest rate, known as the coupon rate, is determined at the time of issuance and remains constant throughout the life of the bond. The fixed interest payments provide bondholders with predictability and a steady income stream.

- Floating Rate Bonds: Floating rate bonds, also known as floating rate notes (FRNs) or floaters, are debt securities having variable interest rates that change periodically based on market rates. This feature makes them less vulnerable to changes in market interest rates compared to fixed-rate bonds.

- Callable Bonds: Callable bonds are debt securities that give the issuer the right (but not the obligation) to redeem or “call” the bonds before their maturity date. When a bond is called, the issuer repurchases the bonds from bondholders at a predetermined price, known as the call price. Callable bonds provide flexibility to issuers but introduce a degree of uncertainty for bondholders.

- Puttable Bonds: Puttable bonds are debt securities that provide the bondholder with the right (but not the obligation) to sell the bonds back to the issuer before the scheduled maturity date. This feature gives bondholders the ability to “put” the bonds back to the issuer, typically at par value, and receive the principal amount.

- Extendable Bonds: Extendable bonds, also known as extendible bonds, are debt securities that provide the bondholder with the option to extend the bond’s maturity beyond its initial maturity date.

Examples of bonds in finance

Bonds are widely used by corporations and governments to raise capital. Here are a few examples of bonds in finance:

- U.S. Treasury Bonds: These are issued by the U.S. government to finance its operations and pay off existing debt. They are considered to be the safest investment option and serve as a benchmark for other bonds.

- Apple Inc. Corporate Bonds: Apple Inc., one of the world’s largest technology companies, has issued corporate bonds to fund its various business activities. These bonds offer investors an opportunity to invest in Apple’s debt and earn attractive yields.

- New York City Municipal Bonds: The city of New York issues municipal bonds to fund public projects such as schools, hospitals, and transportation infrastructure. These bonds offer tax advantages to investors and are backed by the city’s taxing authority.

Factors to consider when investing in bonds

Before investing in bonds, there are several factors to consider to make informed investment decisions.

- Creditworthiness of the issuer: Evaluate the credit rating of the bond issuer to assess the risk of default. Credit rating agencies such as Moody’s and Standard & Poor’s provide ratings for bonds based on the issuer’s financial health.

- Interest rate environment: Consider the prevailing interest rate environment and how it may impact bond prices. Falling interest rates generally lead to higher bond prices, while rising interest rates can result in price declines.

- Bond’s maturity: Assess the time horizon for your investment and choose bonds with appropriate maturities. Longer-term bonds tend to offer higher yields but are also more sensitive to interest rate changes.

- Diversification: Spread your bond investments across different issuers, industries, and types of bonds to reduce risk and enhance returns.

Bond market trends and statistics

The bond market is a dynamic and constantly evolving landscape. Understanding the current trends and statistics can help investors make informed decisions.

- Interest rate movements: Monitor changes in interest rates, as they have a significant impact on bond prices. Keep track of central bank policies and economic indicators that influence interest rate decisions.

- Yield spreads: Compare the yields offered by different bonds to assess their relative value. Yield spreads provide insights into market sentiment and the perceived risk associated with different types of bonds.

- Default rates: Stay informed about historical default rates and trends in the bond market. This information can help assess the creditworthiness of issuers and the risk associated with specific bonds.

- Issuer and sector analysis: Analyze the financial health of bond issuers and the underlying sectors they represent. This analysis can provide insights into the potential risks and opportunities associated with specific bonds.

Conclusion

Bonds play a vital role in the world of finance, providing a means for corporations and governments to raise capital. Understanding the basics of what a bond is and how it works is essential for investors seeking to diversify their portfolios and generate stable income. While bonds offer several advantages, such as stability and income generation, they also come with potential risks, including interest rate and credit risks. By considering factors such as creditworthiness, interest rate environment, and diversification, investors can make informed decisions when investing in bonds and navigate the dynamic bond market landscape.

Investing in bonds can be a valuable addition to your investment strategy. If you’re looking to diversify your portfolio and generate stable income, consider exploring the world of bonds today.

Questions and Answers

1. Are bonds long term or short term?

Bonds can be classified according to their maturity, like which is the date when the government/company has to pay back the principal to investors. Maturities can be short term (less than three years maturity), medium term (4 to 10 years maturity) or long term (more than 10 years maturity).

2. Are bonds better for long-term or short-term?

Short-term bonds are ideal for conservative investors , low risk investors, those nearing retirement, or those with financial goals in the near future due to their lower risk and greater liquidity. Long-term bonds offering higher yields are more suitable for investors with higher risk tolerance and longer investment horizons.

3. Is it good to invest in short term bonds?

Short-term bonds typically yield higher interest rates than money market funds, so the potential to earn more income over time is greater. Therefore, short-term bonds appear to be a better investment than money market funds.

4. Is a bond a debt security?

A bond is a debt security, like an IOU. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. When you buy a bond, you are lending to the issuer, which may be a government, municipality, or corporation.

5. What is the difference between a bond and a loan ?

- A bond is a debt instrument that generates returns through interest payments. A loan is a debt instrument that allows you to borrow money.

- Bonds obtain money from the public when companies sell them. Loans obtain funding from a lender, like a bank or specific organizations.

- Bonds usually have a lower interest rate than loans. Bonds can have fixed or variable interest rates.

- Bonds are sold in the public market and can be traded. A loan is issued by a bank, and is not traded on a public market.

- Bonds are priced at a level commensurate with the market’s view of where they should price. Loan pricing is more nuanced.

6. What happens to bonds when interest rates fall?

When the Fed/government increases the funds rate, the price of existing fixed-rate bonds decreases and the yields on new fixed-rate bonds increases. The opposite happens when interest rates go down: existing fixed-rate bond prices go up and new fixed-rate bond yields decline.

7. What is the difference between tax free bonds and tax saving bonds?

Tax-free bonds provide completely tax-free interest income, have a generally higher interest rate and no lock-in period, while tax savings bonds provide tax benefits on the principal amount, have a relatively lower interest rate, a 5-year lock-in period and the interest income is taxable.

8. Is interest on tax free bond taxable?

The interest on tax free bonds are non-taxable. This means that investors will not have to pay any tax on the income earned from tax free bonds in addition to capital protection and fixed annual income.

9. What are the disadvantages of tax free bonds?

Fixed Rate of Return: Tax-free bonds offer a fixed rate of return, which means that investors may miss out on higher returns if interest rates rise in the future. Inflation Risk – Since tax-free bonds offer a fixed rate of return, investors are exposed to inflation risk.

10. Should you have bonds in your portfolio ?

Bonds are considered a defensive or safe asset class because they are typically less volatile than some other asset classes such as stocks. Many experience investors includes bonds in their portfolio as a source of diversification to help reduce volatility and overall portfolio risk.

11. How to invest in bonds ?

After completing KYC (Know Your Customer) requirements, investors can buy and trade in the bond market through brokers and online platforms.

In India, Zerodha, GoldenPi, ICICI Direct, HDFC Securities, and AxisDirect are popular platforms for bond trading. The RBI’s Retail Direct is also a platform for investing in government securities. In detail article on RBI’s Retail Direct

In the U.S., major brokerage platforms such as Fidelity, Charles Schwab, E*TRADE, TD Ameritrade and Vanguard offer bond trading services.

Read more

Learn with FinanceWisdom4U to continue growing financial knowledge and become an independent financial decision-maker.